If the calculator you’re using doesn’t include this feature, you can check online lenders and banks for rates.

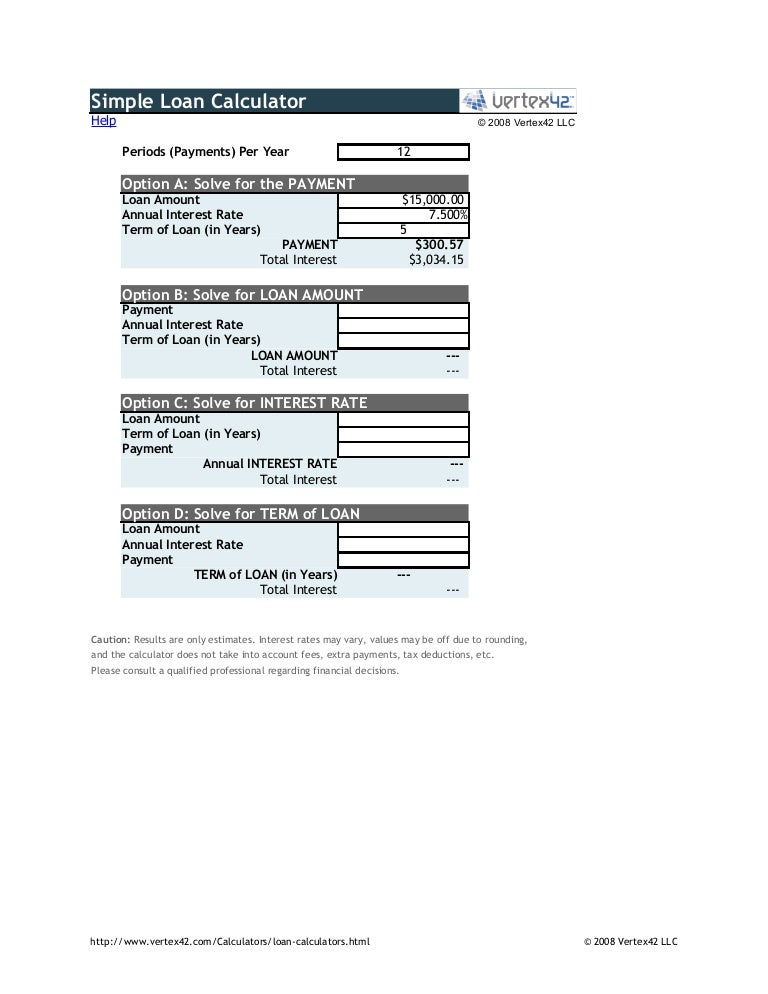

Car price : With some calculators, you’ll only enter the amount you want to borrow.We explain the parts of a car loan calculator in further detail below. You can adjust factors in the calculator, such as how many months you want to pay your car loan, to see how your monthly payment would change. Making a larger down payment may also get you a lower auto loan rate.Īn auto loan calculator considers the car price, loan term and interest rate to tell you what your monthly payment would be. Note that new cars typically have lower rates than used cars because they are less risky for lenders. Age of the vehicle you wish to purchase.Several factors will impact your auto loan rate from a dealership or third-party lender, including: You may or may not find similar terms from the dealership, bank or credit union you finance your car purchase with. Keep in mind that an auto loan payment calculator likely can’t tell you what loan terms you qualify for based on this information. Most auto loan calculators ask for standard information, such as: It can also be used to ensure the dealership or lender you finance your new or used car with isn’t trying to inflate your monthly payment. With a calculator, you can determine how large a loan you can afford to take on and, as a result, how much car you can afford.

A car loan calculator is a tool you can use to analyze your car loan options before making a purchase.

0 kommentar(er)

0 kommentar(er)